3 Dec, 2022 (Sat)

Finance: Budgeting

5: Tips to Help You Find the Best Tiler on a Budget by Shalini M. If you don't fix a few things in your house quickly, it will look unkempt and messy.For instance, if the tiles aren't put in the right way, your house won't look good.The property's curb appeal may suffer as a result of these minor errors.

By Shalini M., "8 Tips to Help You Save Money for a Down Payment" Living outside of your home can make it hard to save money.But if you want to buy a house, we recommend saving at least some of your money for a down payment.Since each circumstance is unique, you might need to advance at least 5% of the worth of the credit.

Ronali Dela Cruz's 7 Ways to Cut Back on Your Spending Without Feeling Deprived Reducing your spending doesn't mean giving up most of the things that make our lives enjoyable and enjoyable. As evidence, this article provides several suggestions.

Ideal Capital Portion Methodologies: By James Gaius Ibe, CFOs Are Thinking About Business Systems Agility and Resilience Despite the fact that disruptions frequently reveal the potential vulnerabilities of business systems, procedures, and processes, they also provide insights into business agility the capacity for rapid change and for flexibility in operations and resilience the capacity to anticipate, recover from emergencies, withstand difficult conditions, or recover quickly from them.

By Shalini M., "8 Tips to Help You Save Money for a Down Payment" Living outside of your home can make it hard to save money.But if you want to buy a house, we recommend saving at least some of your money for a down payment.Since each circumstance is unique, you might need to advance at least 5% of the worth of the credit.

Ronali Dela Cruz's 7 Ways to Cut Back on Your Spending Without Feeling Deprived Reducing your spending doesn't mean giving up most of the things that make our lives enjoyable and enjoyable. As evidence, this article provides several suggestions.

Ideal Capital Portion Methodologies: By James Gaius Ibe, CFOs Are Thinking About Business Systems Agility and Resilience Despite the fact that disruptions frequently reveal the potential vulnerabilities of business systems, procedures, and processes, they also provide insights into business agility the capacity for rapid change and for flexibility in operations and resilience the capacity to anticipate, recover from emergencies, withstand difficult conditions, or recover quickly from them.

It goes without saying that a sound business strategy aimed at maximizing an organization's capacity to generate wealth necessitates an efficient capital allocation strategy. In this series on the best strategies for allocating capital, we'll talk about the adaptability and resilience of business processes and systems and offer some helpful advice.As we consider industry best practices in business systems agility and resilience, the primary objective of this article is to highlight some important portfolio CFOs.Please seek the advice of an experienced professional for specific financial management strategies.

American Economics Underwent a Copernican Revolution!

$4 Trillion from Rick Osbourne!That is the annual average growth rate of the American economy.That is the average amount of new value that the American economy creates annually.330 BILLION!That approximates the United States population in 2021.So, if you divide $4 trillion by 330 million people, the average annual growth rate of the American economy is $12,000 per person.

The effects of COVID-19 on Canadians' personal finances may be severe despite government assistance, according to Michel A. Bell. In any case, presently may be helpful to pursue difficult choices to reset pivotal way of life decisions that prompted huge obligation develop since the Incomparable Downturn.

How much do you pay for things you get for free?

by Joe Barbieri In reality, there is no such thing as free stuff; someone must make the product and pay for its production.

American Economics Underwent a Copernican Revolution!

$4 Trillion from Rick Osbourne!That is the annual average growth rate of the American economy.That is the average amount of new value that the American economy creates annually.330 BILLION!That approximates the United States population in 2021.So, if you divide $4 trillion by 330 million people, the average annual growth rate of the American economy is $12,000 per person.

The effects of COVID-19 on Canadians' personal finances may be severe despite government assistance, according to Michel A. Bell. In any case, presently may be helpful to pursue difficult choices to reset pivotal way of life decisions that prompted huge obligation develop since the Incomparable Downturn.

How much do you pay for things you get for free?

by Joe Barbieri In reality, there is no such thing as free stuff; someone must make the product and pay for its production.

The difficulty lies in the fact that the merchandise's cost may be delegated to a different party or paid for in a covert manner.How can you pay for things that are free?with limitations, pressure, and time, as opposed to what you normally do.

Donald G. Gaw's Some Things ARE Real shows that being skeptical is not a bad thing.Since most people don't have much money, it makes sense to sign up for something free so you can test it out before signing anything.

Mick Manley, an Omaha insurance agent and philanthropist, writes Farmers Insurance Agency Offers Advice to Help Ensure Financial Health. He suggests the following for ensuring financial health for the upcoming year and beyond:Establish a budget and adhere to it.Make two columns, one for income and the other for expenses, and then add them up.Whether you make as much money as you spend, look for ways to save money on luxury items, pay off debt, and increase savings. Add line items to your budget for things like taxes, savings, money for college and vacation by Mick Manley OMAHA, Neb. - College students are packing their bags and getting ready to return home for the summer.For many, managing their own laundry, classes, and curfew, as well as their own bank accounts, without their parents was their first experience this past year.

Marc B. Entz's 8 Simple Ways to Save Money reveals that starting to save money can be difficult at times.Finding simple ways to save a lot of money and how to use your savings to achieve your financial goals can be challenging.

Donald G. Gaw's Some Things ARE Real shows that being skeptical is not a bad thing.Since most people don't have much money, it makes sense to sign up for something free so you can test it out before signing anything.

Mick Manley, an Omaha insurance agent and philanthropist, writes Farmers Insurance Agency Offers Advice to Help Ensure Financial Health. He suggests the following for ensuring financial health for the upcoming year and beyond:Establish a budget and adhere to it.Make two columns, one for income and the other for expenses, and then add them up.Whether you make as much money as you spend, look for ways to save money on luxury items, pay off debt, and increase savings. Add line items to your budget for things like taxes, savings, money for college and vacation by Mick Manley OMAHA, Neb. - College students are packing their bags and getting ready to return home for the summer.For many, managing their own laundry, classes, and curfew, as well as their own bank accounts, without their parents was their first experience this past year.

Marc B. Entz's 8 Simple Ways to Save Money reveals that starting to save money can be difficult at times.Finding simple ways to save a lot of money and how to use your savings to achieve your financial goals can be challenging.

This little by little manual for cash saving propensities will help you foster a reasonable investment funds set up.

R. Williams offers five sound financial advice for newlyweds. Getting your finances in order will ensure a lifetime of financial bliss.After all, a married couple's emotional well-being is just as important as their financial security.

Financial Fitness for the Rest of Your Summer by Patrick Redo Now that summer is half over, it's important to plan your finances for the rest of the summer so you don't spend too much and end up in debt.In an effort to maintain your financial health throughout the summer, why not reevaluate your financial objectives by keeping track of your progress thus far?

Planning In Your 20s:How Can I Begin?

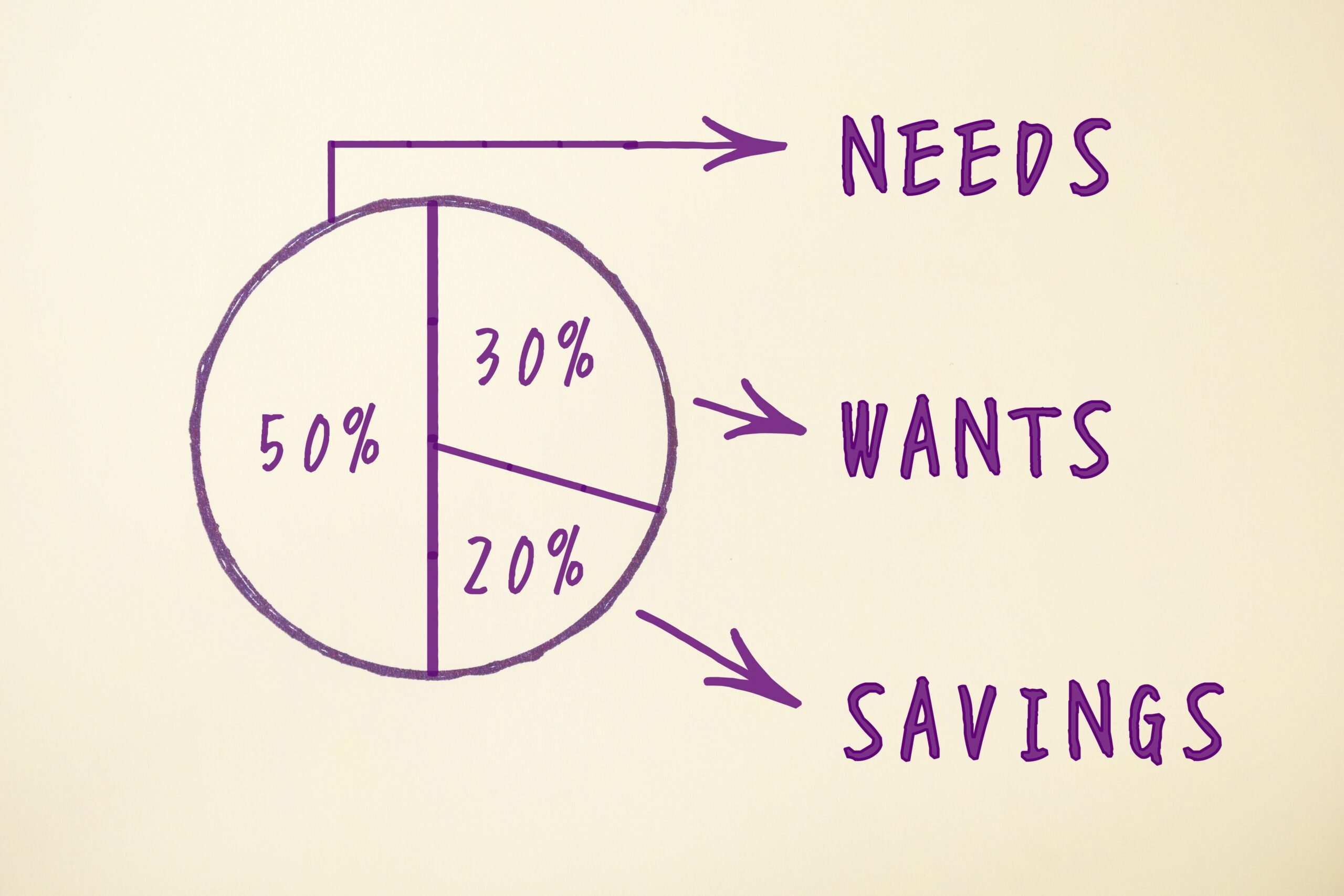

by R. Williams: If you want a bright future, you need to make the right financial choices and live life to the fullest without having to worry about anything.You should begin developing solid financial habits, such as budgeting, in your 20s if you want to ensure a stress-free retirement.

Michel A. Bell's "Budget Remaining at Year-End" describes a budget that is only available to accomplish the goal.What then takes place?Learn what a budget is not first.It's anything but a container to collect assets for different exercises.Nor is it a restraint, nor a plan to show what we can't do.A budget is a highly targeted tool made to accomplish specific objectives.We can best estimate how much time, effort, and money will be needed to achieve particular objectives.I reiterate:As we approach the end of the year, the budget does not contain funds for reckless spending.

Michel A. Bell's "Budgeting Like Dieting Doesn't Work, Here Is an Alternative" argues that people don't incorporate budgeting like dieting into their daily routines.

R. Williams offers five sound financial advice for newlyweds. Getting your finances in order will ensure a lifetime of financial bliss.After all, a married couple's emotional well-being is just as important as their financial security.

Financial Fitness for the Rest of Your Summer by Patrick Redo Now that summer is half over, it's important to plan your finances for the rest of the summer so you don't spend too much and end up in debt.In an effort to maintain your financial health throughout the summer, why not reevaluate your financial objectives by keeping track of your progress thus far?

Planning In Your 20s:How Can I Begin?

by R. Williams: If you want a bright future, you need to make the right financial choices and live life to the fullest without having to worry about anything.You should begin developing solid financial habits, such as budgeting, in your 20s if you want to ensure a stress-free retirement.

Michel A. Bell's "Budget Remaining at Year-End" describes a budget that is only available to accomplish the goal.What then takes place?Learn what a budget is not first.It's anything but a container to collect assets for different exercises.Nor is it a restraint, nor a plan to show what we can't do.A budget is a highly targeted tool made to accomplish specific objectives.We can best estimate how much time, effort, and money will be needed to achieve particular objectives.I reiterate:As we approach the end of the year, the budget does not contain funds for reckless spending.

Michel A. Bell's "Budgeting Like Dieting Doesn't Work, Here Is an Alternative" argues that people don't incorporate budgeting like dieting into their daily routines.

Typically, a finance professional will suggest a task.Is there a better way to accomplish the objectives of budgeting?The vast majority spend and attempt to save what is left, normally, not much if any."Do not save what is left after spending;," advises Warren Buffet.instead, use the remaining savings."The query is now:How do you figure out how much you should keep?

Planning for Preference or Perception?

by Doug Buss The holidays are a time for shopping, parties, and fun.Tis the season to apply outrageous channel on our energy, closet and wallet.This is the time to spend.

Bob Tom's 12 Ways to Save Money on Baby Gear details how expensive baby care can generally be.When it comes to buying baby gear, new parents should take advantage of saving strategies whenever they can.There are a variety of baby items, including;child diapers, child clothing, carriages, play yards, and considerably more.

By Doug Buss, "Make It About Memories, Not Money" Now that school is out, it's time to consider how to keep ourselves and the kids entertained for two months.Let's be smart about it and save money at the same time.

Emily Perkes's book "Saving Money by Buying More" provides some helpful advice on setting a budget.The straightforward suggestions and tactics in this article will help you stretch your grocery budget.

Planning for Preference or Perception?

by Doug Buss The holidays are a time for shopping, parties, and fun.Tis the season to apply outrageous channel on our energy, closet and wallet.This is the time to spend.

Bob Tom's 12 Ways to Save Money on Baby Gear details how expensive baby care can generally be.When it comes to buying baby gear, new parents should take advantage of saving strategies whenever they can.There are a variety of baby items, including;child diapers, child clothing, carriages, play yards, and considerably more.

By Doug Buss, "Make It About Memories, Not Money" Now that school is out, it's time to consider how to keep ourselves and the kids entertained for two months.Let's be smart about it and save money at the same time.

Emily Perkes's book "Saving Money by Buying More" provides some helpful advice on setting a budget.The straightforward suggestions and tactics in this article will help you stretch your grocery budget.

Join the conversation